Written by Cindy Gamal.

Only Warren Buffett can make a defensible argument for the goodness of greed. In his evolution from a “cigar-butt” investor, acquiring and selling businesses with only “one good puff” left, he learned to recognize opportunities others avoided because of fear. In a 1986 Chairman’s Letter to Berkshire Hathaway’s shareholders, he says:

“…occasional outbreaks of two super-contagious diseases, fear and greed, will forever occur in the investment community. The timing of these epidemics will be unpredictable. Therefore, we never try to anticipate…our goal is more modest: we simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.”

Buffett’s case for greed is actually wisely opportunistic.

From fear to opportunity

The Silicon Valley Bank’s recent shutdown has added to the existing concerns of a looming recession, leaving many founders and investors unsure and even afraid about the future. Founders we are talking to are apprehensive and prefer to defer fundraising until valuations are healthier. Investors fear their portfolio’s performance and down rounds.

But we see things differently. As it turns out, Buffett was right and we have reason to be optimistic while others are fearful.

Reasons to invest during this recession

Focusing on strong fundamentals, understanding product and technology cycles, and embracing current technological trends present unique hope for investors in the VC space right now.

Strong fundamentals still prevail

Source: Crunchbase News

During the 2008 recession, we saw early-stage VC funding grow and, subsequently, VC returns also peaked. Why did this happen? These businesses that focused on solving problems that emerged or remained crucial in recessionary periods proved to be good investments.

Two success stories from that period are Airbnb, which addressed high vacation hotel costs, and Uber, which provided people with side incomes. These companies targeted the right problems relevant to that time which leveraged them for success. Airbnb and Uber are not alone in their success during that recession —they share the era’s VC peak performance with other household brands.

Source: Stonks.com, Bloom Ltd.

Similarly, startups can now position themselves to survive the market’s filtering process by building strong foundations that will enable them to become successful in the long run, by adhering to fundamentals like focus on product-market fit, key metrics, and runway.

One of our ventures, Crewscope, demonstrates the type of opportunity we expect to see in this current economic climate. Crewscope focuses on a problem further exacerbated by the recession—at a time when construction companies are rejecting new revenue because they lack enough labor. Crewscope helps construction companies win and retain top talent by aligning fieldworkers’ goals and incentives with the company so the company can increase its productivity.

Technology isn’t afraid, and it isn’t slowing

Understanding product and technology cycles

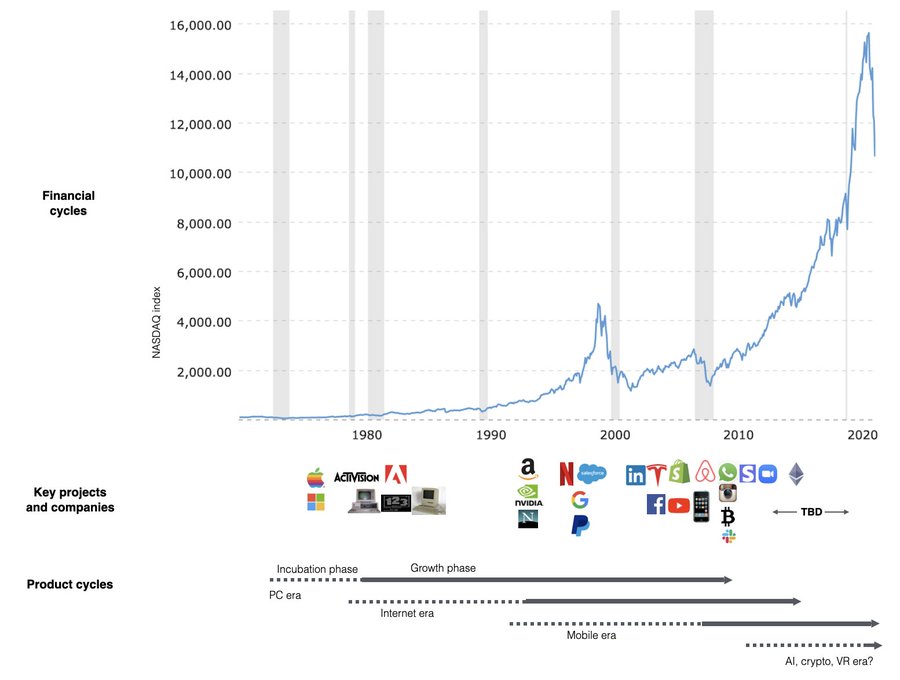

Technology continues to advance and offer important solutions during a recession. Product cycles and economic cycles don’t always align and therefore investing based on economic signals isn’t always productive.

To further illustrate the mismatch between product cycles and financial cycles, we know that the 2008-2010 period of economic struggle saw the start of the mobile era, with companies like WhatsApp, Instagram, Uber, and Venmo leading the way (See chart below). These companies leveraged new technologies to solve real problems and create value, despite the recession.

Source: Chris Dixon via Twitter

Embracing AI Innovation

AI is a perfect example of a technological innovation whose pace is not affected by the economic cycle. It appears that the mobile era of 2008 is mirrored in today’s AI, with OpenAI sparking rapid commercial innovation (read more about what Bill Gates thinks about the future of AI here).

This is a time of great potential and promise for startups, and we’re excited to be a part of it—so much so that verticalized generative AI is one of FutureSight’s core theses. Generative AI’s ability to boost business performance is now well accepted. We believe in taking it a step further. Verticalizing the AI model will better solve unique problems through the use of proprietary industry data, specialized language models, and niche workflows.

Landslo, one of our startups, uses a vertical AI approach in the real estate space to hone in on the conversations end customers are looking for on housing and mortgages. Taking this vertical approach allowed them to create a language model that beats best-in-industry solutions.

Time to welcome “greed”!

The current market situation presents a unique opportunity for investors to seize the day and invest in the next generation of successful startups. Founders in this market who build great companies with strong fundamentals and leverage the technological timing and demand will be appealing to investors.

The future is bright for startups, and we’re here to help you make the most of it.

If you’d like to get in touch, reach out to me here.