Written by John Carbrey, in collaboration with Stephen Baldwin.

This article introduces a risk model that helps FutureSight, a B2B SaaS venture studio, determine whether someone is financially and psychologically prepared to start an entrepreneurial journey.

The model rests on our belief that taking risks is fundamental to entrepreneurship. To start a venture is to take on substantial financial and personal investment with no guarantee of success.

That being said, the risk-reward equation isn’t balanced. When done right, entrepreneurship consists of taking a calculated and limited risk for the chance at an exponentially higher reward. That equation looks even more appealing in the COVID-19 era, when potential tech entrepreneurs are seeing an unprecedented opportunity to solve market problems, as well as a job market that may take years to return to full strength.

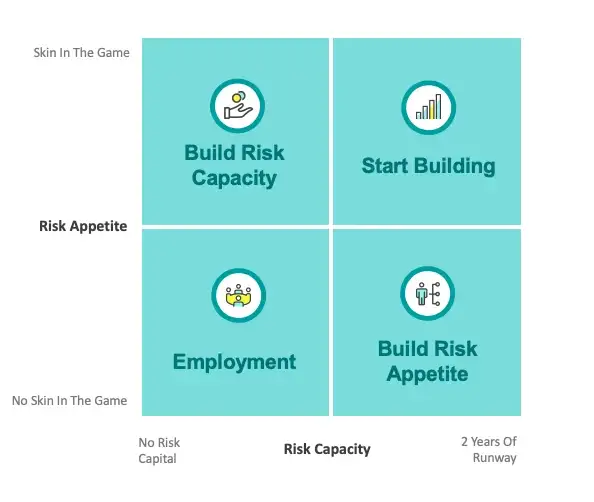

We hope this model, which measures entrepreneurial fitness based on the intersection of financial risk capacity and risk appetite, can help you determine where you are now and where you need to be if you want to start building.

Risk Capacity

We define risk capacity as a founder’s ability to finance their startup’s launch. This launch phase includes both searching for a compelling business opportunity and forming the venture (the latter could include building the initial product and getting initial customers on board).

Here are some questions we ask aspiring entrepreneurs to determine their risk capacity:

- Do you need a salary?

- If so, how much do you need?

- If not, how long can you go without one?

The first step is to take an inventory of what you need financially to support you and your family. This is a subjective assessment which, if you have a partner, requires frank conversation and a joint commitment. (Partners of entrepreneurs often pay the highest price.)

You will have to make significant financial sacrifices to make this work. You will aim to live as frugally as you can and invest any excess capital into the business, which has significant upside potential.

If you need to maintain a $200K salary and don’t have any easily accessible savings, you likely aren’t in the right place to start a venture. Either this isn’t the right path, or you need to build your capacity. In the meantime, you can get involved in early-stage startups to learn about what to expect.

Once you’ve calculated your minimum living expenses, you can assess how much “runway” you have to start a business. We estimate that 12–18 months will give you enough time to iterate through a number of venture ideas and get some traction without having to end the process prematurely.

The discovery process can’t be rushed. Taking the proper time to validate your solution can have an exponential impact on the product’s success. Every time you learn, you get better.

The above questions are basic, but they’re only meant to be starting points. The takeaway is that you shouldn’t go into entrepreneurship blind. Don’t wait until you’ve gone too far to know how far you can go.

We’ve focused here on financial risk capacity (the predominant consideration among entrepreneurs), but there are several other categories to consider:

- Relationship Capacity (Do your loved ones understand the risk you’re taking on?)

- Mental Health Capacity (Can you endure the anxiety, pressure, and prolonged focus that’s required of an entrepreneur?)

- Time Capacity (Can you put the time in to make the venture a success?)

Risk Appetite

The research on how people are wired for risk-taking touches psychology, sociology, economics, and anthropology, but we’ve found none of these theories are as accurate as the idea of having “skin in the game.”

To have skin in the game is not only being willing but desiring, to take responsibility for significant potential losses in pursuit of far more significant gains. It’s owning both the upside and downside.

No one captured the sentiment of skin in the game better than U.S. President Theodore Roosevelt in his classic “Citizenship in a Republic” speech delivered in 1910. (Of course, we would write this in a more gender-neutral way today.)

It is not the critic who counts; not the one who points out how the strong person stumbles, or where the doer of deeds could have done them better. The credit belongs to the one who is actually in the arena, whose face is marred by dust and sweat and blood; who strives valiantly; who errs, who comes short again and again, because there is no effort without error and shortcoming; but who does actually strive to do the deeds; who knows great enthusiasms, the great devotions; who spends themself in a worthy cause; who at the best knows in the end the triumph of high achievement, and who at the worst, if they fails, at least fails while daring greatly, so that their place shall never be with those cold and timid souls who neither know victory nor defeat.

“Skin in the game is mostly about justice, honor, and sacrifice, things that are existential for humans,” Nasim Taleb writes in his book “Skin in the Game: Hidden Asymmetries in Daily Life.”

The book traces the dynamic of taking on risk versus transferring it to others back to ancient Rome:

This idea of skin in the game is woven into history … with a few curious exceptions, societies were run by risk takers, not risk transferors. Prominent people took risks — considerably more risks than ordinary citizens. The Roman emperor Julian the Apostate … died on the battlefield fighting in the neverending war on the Persian frontier — while emperor. … There is no better historical evidence of an emperor taking a frontline position in battle than a Persian spear lodged in his chest (Julian omitted to wear protective armor). (P. 24–25)

True entrepreneurs must be risk-takers. It’s not about how extreme the risk is, but more fundamentally about how you perceive risk.

A talented women’s tennis player must make tremendous physical, psychological, social, and financial sacrifices in order to play at Wimbledon. She’ll compete for one of 32 seeds with more than 2,500 pro players and tens of thousands of aspiring pros. It’s not a gamble, but a calculated risk she’s taken based on objective evidence of her talent and focus, and the significance of the reward. Whichever way it goes, she is bearing the weight of that responsibility.

FutureSight has spoken to many experienced leaders who are enamoured with entrepreneurship but clearly didn’t want any part of the downside. They didn’t want skin in the game. In our experience, a good founder won’t shy away from the responsibility. They’ll embrace it.

Here are some questions you can ask yourself to gauge your risk appetite:

- Who do you aspire to become? Who are your vocational heroes?

- Have you and/or would you make short- and mid-term sacrifices in order to achieve long-term objectives?

- Do you have a history of willingly taking on accountability and responsibility?

- Do you want to financially own the results of your failure or success?

- To what degree is your motivation to reach your goals intrinsic (vs. extrinsic)?

- Are you afraid of failure? Does that fear prevent you from pursuing challenging and life-changing goals?

- If you have the capacity, are you willing to materially invest your own capital into this venture?

Here’s how Alpha Edison managing director Nick Grouf characterized an entrepreneur’s relationship with risk in a 2018 post:

“There is an intuitive art to risk tolerance and risk management: some are born with that intuition, and the rest of us work at it day to day. It is that first big plunge — the decision to leave a more stable path, and begin forging your own business and bringing a brand-new idea to life — that throws off the vast majority of people.”

Conclusion

I’ve found this capacity vs. appetite model to be surprisingly accurate, despite its subjectivity. But we’ll continue to build on it.

If you find yourself in or near that top-right quadrant after weighing your risk capacity and risk appetite, and you’re ready to take the plunge into entrepreneurship, we’d love to chat. FutureSight is co-creating ventures with all kinds of outstanding entrepreneurial leaders, and we’re more than willing to put our own skin in the game.