Note: We have now released a whitepaper on startup studio structures which includes the content below, we’ve found the whitepaper format is more fitting than Medium for most readers.

Written by John Carbrey.

As startup studios emerge as a new asset class in the innovation ecosystem, key questions of how studios should be structured and the optimal model for investors to participate in studios remain unanswered.

The purpose of this article is to address a number of these questions both for venture studio founders as well as venture studio investors. The more we can collectively standardize our approaches to structuring startup studios and making them investment ready the better.

Some of the key questions that are being asked include:

- How are startup studios structured?

- What startup studio structures are working best?

- What startup studio structures are not working?

- How can startup studio founders avoid confusing investors?

- How can startup studios work together to standardize our structure as we present to investors?

- What are the most sustainable structures for startup studios?

The goal of this article is to answer these questions as conclusively as possible.

Reviewing Startup Studio Structures

In our research, there are five most common startup studio structures that we are seeing globally. These include the following:

- Single Fund Model

- Single Fund Model Foundry

- Dual Entity Model

- Single Studio Model

- Single Studio Model + Syndicate

In the following sections, we review each of these models and explore their pros and cons.

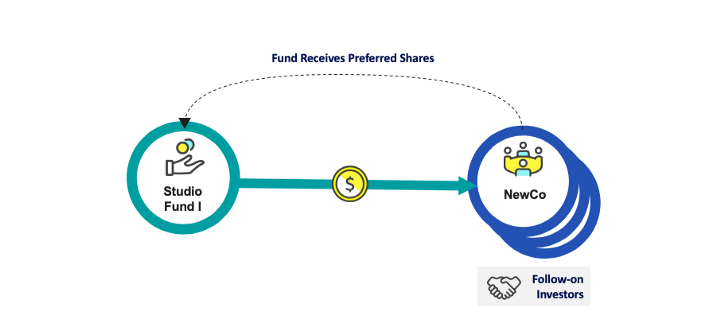

Single Fund Model — Fund as Venture Studio

Key Model Points

- This is a single fund entity

- It has high fees and high carry to cover incubator costs.

- All equity sits within the fund — both founder provisions and purchased equity

The exception to having high fees and high carry would be in cases where there is a large fund that can finance the studio operations off of classic VC management fees.

Benefits and Disadvantages

Benefits

- The simplicity of single fund entity

Disadvantages

- High fee load on smaller funds to cover incubation overhead

- High carry allocation across a large incubation team to incentivize operational efforts on incubation

- Signalling issues if the fund does not lead or participate in a funding round

- A high level of fund commitment may bias a decision to stop funding an incubated company or write it down

- Portfolio companies may not get incubated to the point of viability or may get funded before they are ready

Single Fund Model Foundry — Foundry with Bill Back

In this approach, you have a fund that is directly investing in NewCos. Each NewCo has the studio founders on the cap table. Then there is an operating studio where the larger studio team sits with the staff and its associated costs. A bill back relationship between the NewCos and the operating studios ensures that the operating studio would, in the end, break-even because the NewCo’s are covering the ongoing costs.

Key Model Points

- This is a single fund entity — a fund with standard carry & fee allocation

- A Limited Partner Advisory Committee (LPAC) agreement allows management and fund staff to have direct equity allocation in foundry companies

- An LPAC agreement that allows the operating studio to invoice portfolio companies $X / month for overhead

- LP’s receive X% direct allocated equity in a foundry company

Benefits and Disadvantages

Benefits

- Single structure

- Portfolio companies can allocate LP equity from new cap tables — no pre-existing investors or signalling issues

- LP direct equity is not subject to the fund’s carry provisions

- NewCos pay for management overhead instead of LP’s

- LP’s could potentially receive direct equity allocation

Disadvantages

The largest disadvantage in this model is that there is a potential misalignment between investors and studio founders. The key challenge is aligning investor interests when the studio founders are involved as founders and as follow-on investors in these companies?

Other disadvantages include:

- Studio management incentivized to create more companies to increase overhead/fee load

- Studio management incentivized to focus on single winning companies due to direct management allocation on companies

- Fund returns may not correlate with management returns

- No/limited ability to incubate companies that are not conceived and initially owned by the foundry

- Significant risk that fees are not collected from all companies, materially affecting the operational cash flow of the foundry

- Outside investor signalling — why aren’t LP direct investors leading or participating?

- Outside investor reaction — billing companies is a non-standard VC practice

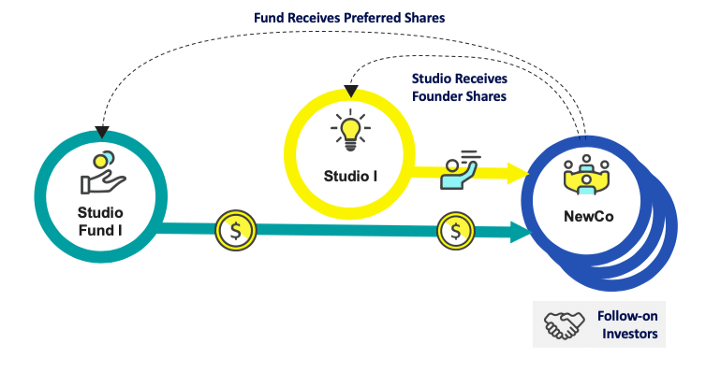

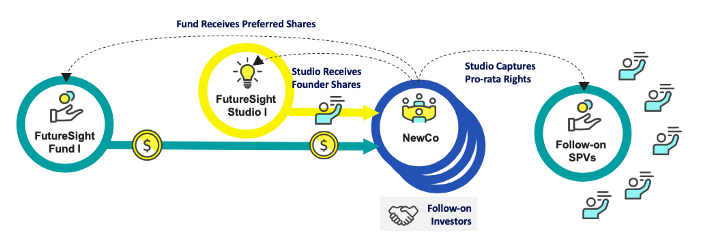

Dual Entity Model — Fund and Studio Pairing

This structure is a dual structure with distinct studio and fund elements. When you are creating NewCos, the studio receives common shares, and the fund receives preferred shares in the companies that spin out.

The fund is comparable to a VC fund in the structure where the management fee charged by the studio is 2–2.5% per year with similar carry. As venture studios typically have higher expenses than a 2% management fee , particularly in the early stage of the studio given the initial limited fund size, the fund’s first investment would be in the studio itself. That investment has the benefit of giving the fund access to a portion of the common shares that typically would go to the studio. This investment doesn’t have to be structured as an equity interest in the studio; it could be a debt instrument. In either case, the understanding is that a portion of the common shares are given to the fund as part of its investment in formation.

Key Model Points

- Dual entity model

- Fund with standard carry & fee allocation

- Studio with X% owned by fund through $Y investment

- No restrictions on the use of Studio capital for incubation operations

- Studio allows fund a pre-funding right at preferred terms

- Studio syndicates future pro-rata rights to the fund from incubated common equity at $0 cost.

The syndication of future pro-rata rights is a significant benefit studios can offer and it is distinct from what a typical VC would offer. If you were able to double down in a normal seed VC scenario, investors could quadruple down on breakout companies in a studio context.

Note: Dual Entity is similar but different than having an OpCo with a side-car fund. In an OpCo with a side-car fund, the alignment of studio founders and fund investors is not as strong as what is proposed here.

Benefits and Disadvantages

Benefits

- Management aligned with investors across both vehicles

- No direct equity in incubated companies placed in studio management or studio staff names directly

- Low cost on failed incubated concepts or companies

- Allows for studio management alignment with LP’s

- No “win” for management without a win for LP’s both through ownership in the studio as well as fund exposure to incubated companies

- Provides a built-in viability checkpoint for fund investment — fund investment requires solid fundamentals, team and GP conviction

Disadvantages

- Dual structure complexity

- Variable cost on Fund’s incubated company equity depending on the number of companies incubated

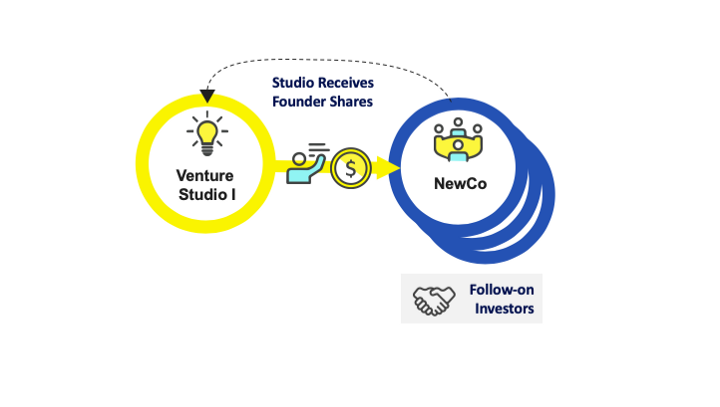

Single Studio Model — Venture Studio Without Fund

This model is as simple as you can get. There is a studio that is forming and funding NewCos. The studio may have common and/or preferred interest in the NewCo’s. But there are significant trade-offs.

Key Model Points

- No carry / no fee economics

- LP’s purchase a fixed % ownership in studio and studio management owns the remainder

- LP’s contribute full capital at the time of subscription

- Studio agrees to operate for a set number of years, typically 3, and draws capital as needed

- Studio typically assigns pro-rata rights/financing right of first offer to LP’s

Benefits and Disadvantages

Benefits

- Nimble for evaluating concepts at-will

- Simple structure

- Studio determines necessary staffing level and capital allocation for projects

Disadvantages

Startup studios are hugely capital intensive. Studios need a significant amount of capital initially to create companies and the successful companies need upwards of 10–20x more capital that the studio initially invests as they grow. In this case, the studio and investors are not getting the value that they typically would in a VC fund from their pro-rata rights. While this is solved in the Dual Entity Structure, in this model the studio isn’t able to capture that follow-on value over time.

- Needs an associated fund to leverage the full value of ROFR and pro-rata

- Complicated process to get LP’s to lead rounds or co-invest

- This alternative structure is difficult to benchmark against traditional funds

- High level of fund commitment may bias a decision to stop funding an incubated company or write it down

- Spending discipline required to avoid investing too deeply in a single company or giving up too early

Single Studio Model + Syndicate — Studio with Extended Syndicate

This model takes the idea of the Single Studio Model but mitigates some of the negatives of that model with the addition of a syndicate. The studio is creating NewCos and when these NewCos need additional investment you create single-purpose vehicles (SPVs) to enable LP’s or a syndicate of angel investors to invest through or alongside the studio.

Overview

- This model introduces the concept of an investor syndicate

- Captures carry through an SPV on follow-on rounds unlike single studio model

- No management fee economics from a fund

- No pre-committed fund capital available to be deployed for follow-on

Benefits and Disadvantages

Benefits

- Relative to the individual studio, this model captures most of the value of ROFR and pro-rata

- SPV typically gives control rights to studio GPs

- Nimble for evaluating concepts at-will

- Simple studio structure

- Studio determines necessary staffing levels and capital allocation for projects

- Syndicate platforms like Zenvest massively simplify follow-on funding

Disadvantages

- Difficult process to get investor syndicate up and running and enable co-investment

- Investor syndicate is not committing to the company creation program but rather individual deals — as a result, some ventures may not be able to be capitalized from the syndicate

- Potential to have alignment issues since studio and investor syndicate ownership are not the same

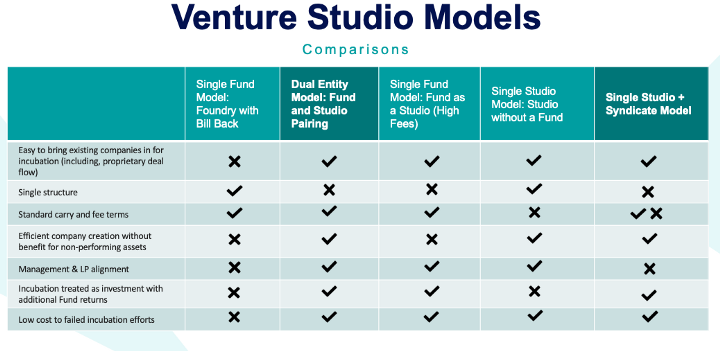

Venture Studio Model — Comparisons

Structure Recommendations

- The diversity of models can be quite confusing to investors to whom venture studios are new

- We should standardize on the model and approach where possible

- Dual Entity Model (Preferred) and Single Studio + Syndicate seem best when evaluated objectively

P.S. Ultimate Model — Dual Entity + Syndicate Model

If we were to design the “perfect” model, it would be a combination of these two approaches. You would have the dual entity model but there are still some pro-rata rights that may not be fully captured. To ensure you capture the economic value of all those rights you could open those up through SPV’s to a larger syndicate of investors. This would be an upgrade to either of these two models once you get up and running.

Note: We have now released a whitepaper on startup studio structures which includes the content above, we’ve found the whitepaper format is more fitting than Medium for most readers.

Acknowledgments — Contributors & Consultation

There have been a lot of contributors to this article. I particularly want to thank Mike Jones (Science) who contributed significant parts of this content. Many thanks to those that provided input as part of the research for this article including Eric Doherty (Cooley), Ash Kirvan (Polymath), Alex Bangash (Trusted Insight), Emilie Boutros (TandemLaunch), Helge Seetzen (TandemLaunch), Quentin Nickmans (eFounders), Alex Maleki (IdeaLab), Eva Wang (AI Fund), Erik Logerquist, Sarah Philips (BoulderBits), and Attila Szigeti.