The venture studio model has gained momentum over the past decade as an alternative way to build startups, one that prioritizes systematic company creation over opportunistic investing. But despite the growing buzz, “venture studio” is still a fuzzy term for many founders, operators, and investors.

So what is a venture studio? How does it work? And how is it different from venture capital funds, accelerators, or incubators?

This article breaks it down.

Venture Studio – A Simple Definition

A venture studio (also known as a startup studio or company builder) is an organization that systematically creates and launches new startups by combining capital, shared infrastructure, and hands-on operational support.

Unlike traditional investors who fund external founders, venture studios are actively involved from day zero with a selected cofounder, generating the idea, validating the market, building early product, and assembling the founding team before the startup company formally exists.The core belief behind the model is simple:

Startups are more likely to succeed when early risk is reduced through repeatable processes, experienced operators, and shared resources.

Why Venture Studios Exist

Traditional startup formation places a heavy burden on individual founders:

- Identify a real, valuable problem

- Validate demand with limited resources

- Build an MVP from scratch

- Recruit talent without traction

- Raise capital before meaningful proof exists

Many promising startups fail not because the idea is bad, but because execution risk is highest at the earliest stages.

Venture studios were created to address this gap by:

- De-risking company creation

- Compressing time to validation

- Applying lessons learned across multiple startups

Treating startup building as a discipline, not a one-off event

How the Venture Studio Model Works

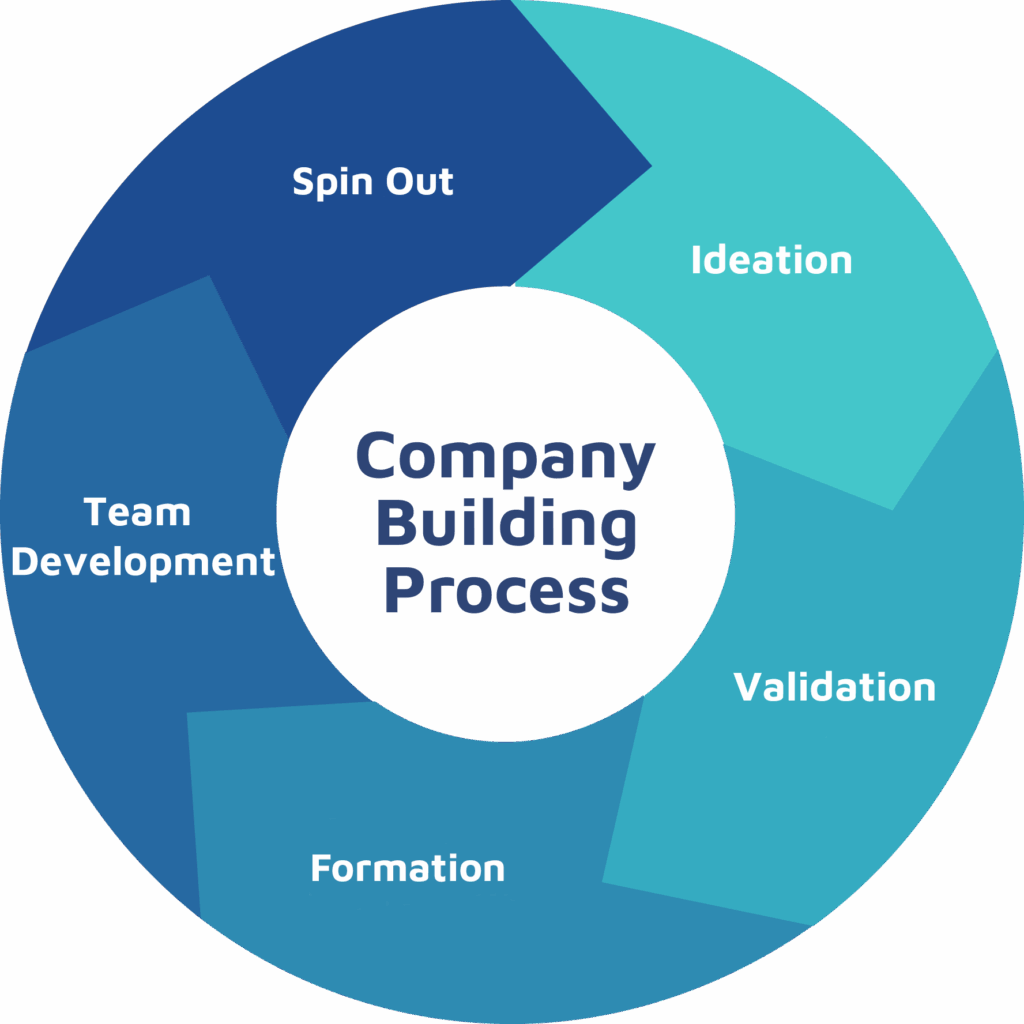

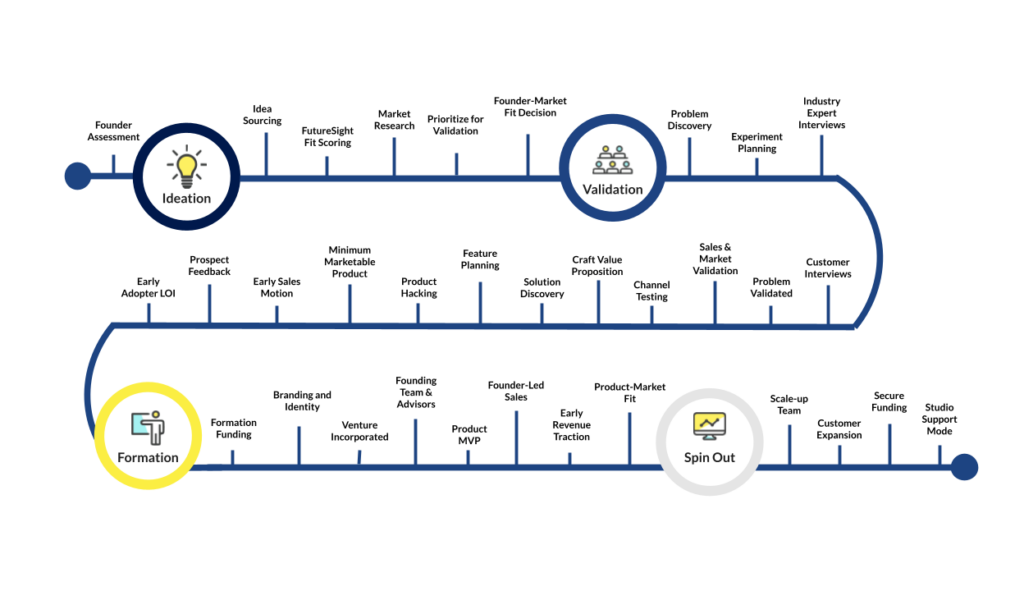

While each studio has its own approach, most follow a structured lifecycle:

1. Idea Generation

Studios proactively generate startup ideas based on:

- Deep industry research

- Identified market inefficiencies

- Operator experience

- Emerging technology shifts

Ideas are not random, they are often shaped by patterns observed across markets and prior ventures.

Explore our perspectives on: Picking Winners in Generative AI and

Verticalization: the Key to Winning in the Generative AI Landscape

2. Validation Before Formation

Before incorporating a company, studios test assumptions through:

- Customer discovery

- Rapid prototyping

- Market sizing and competitive analysis

Only ideas that demonstrate strong signals move forward.

Read related articles on uncovering product-market fit with the right data, why research alone isn’t enough for problem validation, and how we validated AI TradeDesk from concept to market.

3. Company Building

Once validated, the studio:

- Builds early product or MVP

- Provides shared services (engineering, design, legal, finance, GTM)

- Establishes core strategy and positioning

This phase dramatically reduces the “blank-page” problem most founders face.

Curious about FutureSight’s Studio process? Learn more about What we do.

4. Founder Matching or Co-Founding

Studios either:

- Partner with external founders, or

- Recruit entrepreneurs to lead already-validated opportunities

Founders join with momentum, infrastructure, and support already in place.

Want to understand how FutureSight matches founders to opportunities?

Explore What FutureSight looks for in Entrepreneurs in Residence.

5. Spin-Out and Scale

As the startup matures, it becomes an independent company, raises external capital, and scales with decreasing reliance on the studio.

Hear firsthand how Justin Mason and Stephan Thomas describe their experience working with FutureSight as EIRs.

Venture Studios versus Venture Capital Funds

Venture capital firms primarily allocate capital to externally built companies. Their involvement is typically advisory and episodic.

Venture studios, by contrast:

- Focus on execution, not just financing

- Build companies internally

- Are deeply operational

- Take more concentrated ownership

Venture Studios versus Accelerators & Incubators

Accelerators and incubators support existing startups for a fixed period, often through mentorship and small investments.

Venture studios:

- Create companies from scratch

- Work with startups long-term

- Provide full-stack operational support

- Take responsibility for outcomes, not just guidance

The Value Proposition of Venture Studios

The venture studio model offers advantages to multiple stakeholders:

For Founders

- Reduced early-stage risk

- Faster path to product-market fit

- Access to experienced operators

- Built-in support across critical functions

For Investors

- More consistent startup quality

- Earlier insight into company formation

- Repeatable venture creation process

- Better capital efficiency at the seed stage

For Markets

- Faster innovation cycles

- More disciplined experimentation

- Higher signal-to-noise ratio in early startups

When Venture Studios Work Best

Venture studios are especially effective in environments where:

- Markets are complex or regulated

- Deep domain expertise matters

- Technology shifts create new categories

- Early execution risk is high

- Capital efficiency is critical

They are increasingly common in B2B SaaS, AI-native products, fintech, healthtech, and other sectors where thoughtful design and validation matter more than speed alone.

A Different Way to Build Companies

At their core, venture studios represent a mindset shift.

Instead of treating startups as isolated bets, they treat company creation as a repeatable, learnable system, one that improves with every venture launched.

For founders who value collaboration, structure, and shared learning, and for investors who believe execution is as important as ideas, the venture studio model offers a compelling alternative to traditional startup paths.

Want to learn more about FutureSight’s venture studio?

Discover What We Do and Who We Are. Have questions? Check out our FAQs.

Sign up for our LinkedIn Newsletter, The FutureSight Spark.