Written by John Carbrey.

A studio has distinct differences when compared to venture capital firms in value creation. Since venture studios focus on forming new ventures, significant equity value is created through the studio’s operation as a co-founder. The result of this is that studios can create 10x as much value in a venture as a venture capital investor would from their financial capital alone.

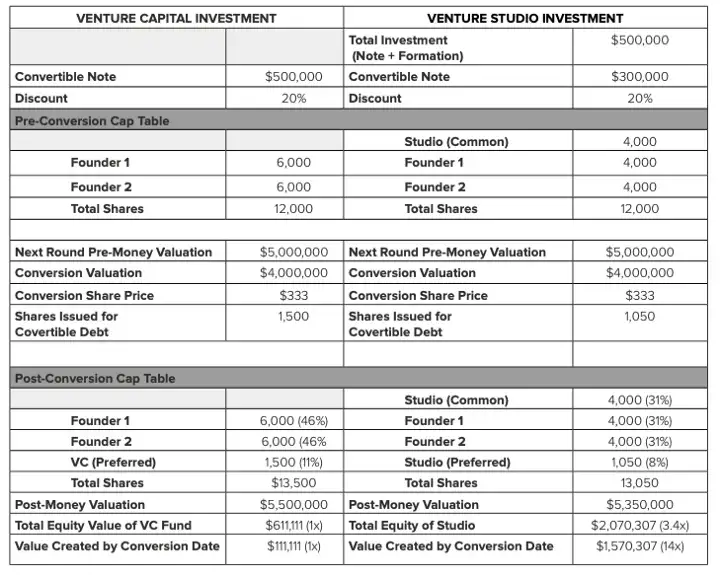

Venture Capital Example vs Venture Studio Example

To explain this further, imagine the following example of a $500k venture capital investment vs a similar scenario in a venture studio. $500k is invested in creating a new technology company — $350k is a preferred investment, and the remainder contributes towards the creation of common equity.

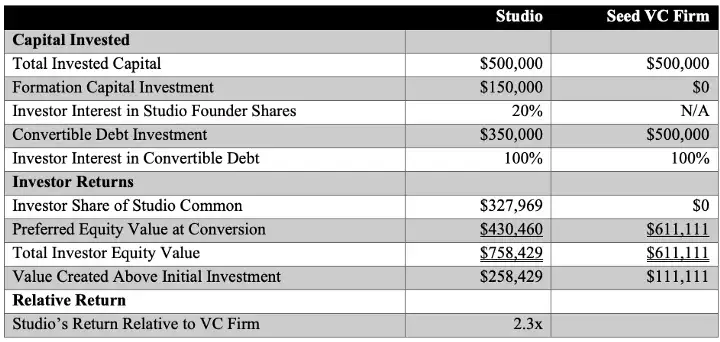

Relative Value Creation Between Studios and Venture Capital Firms

As shown above, even at the early stages of an investment, there is a huge value creation difference between a traditional venture capital firm and a venture studio. In this case, there is 3.4x more equity value in the studio vs. a traditional venture firm. In terms of created value (beyond the initial capital investment), the studio has created 14x more value than a venture capital firm.

These significantly different dynamics result from a founder’s role that studios take vs. a pure securities selection role in venture capital firms.

Comparing Investor Returns

Below is a comparison of relative investor returns in this early stage example.

Assuming studio investors receive 20% of the studio’s common shares, in the example above, investors would have 2.3x the VC firm’s return out of the gate.

Investor Advantages and Investor Returns

For investors, investing in a Studios fund provides many advantages relative to venture capital firms.

Three key advantages include:

- Investors receiving an entry point in breakout companies at the earliest valuations.

- Investors gain the ability to set the inside price of companies.

- The Studio’s pro-rata rights are available to Investors for follow-on investment. In the example above, these studio pro-rata rights are 3.4x more than a VC firm would be able to provide, allowing the ability to quadruple down on the top deals.

Conclusion

The Studio’s fund, when compared to venture capital funds, is distinctive in the following ways:

- The Studio operates as a co-founder creating significant additional equity value.

- The Studio investors receive an entry point in breakout companies at the earliest valuations.

- The Studio investors gain the ability to set the inside price of companies.

- The Studio’s pro-rata rights are available to investors for follow-on investment.

- The Studio’s leadership and the team have significantly more skin-in-the-game and are taking on significantly more downside risk.